- Page 1

- Page 2

- Page 3

- Page 4

- Page 5

- Page 6

- Page 7

- Page 8

- Page 9

- Page 10

- Page 11

- Page 12

- Page 13

- Page 14

- Page 15

- Page 16

- Page 17

- Page 18

- Page 19

- Page 20

- Page 21

- Page 22

- Page 23

- Page 24

- Page 25

- Page 26

- Page 27

- Page 28

- Page 29

- Page 30

- Page 31

- Page 32

- Page 33

- Page 34

- Page 35

- Page 36

- Page 37

- Page 38

- Page 39

- Page 40

- Page 41

- Page 42

- Page 43

- Page 44

- Page 45

- Page 46

- Page 47

- Page 48

- Flash version

© UniFlip.com

- Page 2

- Page 3

- Page 4

- Page 5

- Page 6

- Page 7

- Page 8

- Page 9

- Page 10

- Page 11

- Page 12

- Page 13

- Page 14

- Page 15

- Page 16

- Page 17

- Page 18

- Page 19

- Page 20

- Page 21

- Page 22

- Page 23

- Page 24

- Page 25

- Page 26

- Page 27

- Page 28

- Page 29

- Page 30

- Page 31

- Page 32

- Page 33

- Page 34

- Page 35

- Page 36

- Page 37

- Page 38

- Page 39

- Page 40

- Page 41

- Page 42

- Page 43

- Page 44

- Page 45

- Page 46

- Page 47

- Page 48

- Flash version

© UniFlip.com

international outlook

cess control market

end-user experiences. Building access control requires a detailed knowledge of who, what, where and when, so perhaps it is no surprise that the market continues to be slow moving and perhaps resistant to change. But change is coming, partly driven by other industries that already embrace innovations like mobile/ remote connectivity and the cloud but also by end users becoming more familiar with technologies through use of technological devices in the home and at work. 6. User-friendly solutions are the way forward The access control market has identified that ease of use and familiar technologies could be the key to market advancement. As IHS found, not all end users require pure hardened security but instead are looking for easy and efficient methods of administering their security needs. As a result, various user-friendly style solutions have been launched on to the market, for example, HID Global’s “Twist and Go” gesture technology, Allegion’s Engage technology, Zaplox mobile keys , Clay by Salto - a cloud-based wireless locking solution, Okdoor and Sam API by Brivo Labs, Kevo by Kwikset and many others… 8.New players will drive the market forward Dozens of suppliers now offer both access control and video surveillance. Some video surveillance suppliers – like Axis - have created their own branded solution. Some – like Panasonic and Bravida - have partnered with access control manufacturers and created OEM agreements. Some have free applications – like Video Insight with Monitorcast EDU - to run beside video on the same server to reduce the costs to end users. Google, Apple and various MSOs (AT&T, Comcast, Time Warner, etc.) are also new entrants to the market. IHS researchers believe that new players are a positive for the security industry. While security solutions may not be equal, they are all required today in most enterprise, SMB and government applications. Even the residential market is now looking for video, electronic access control and intrusion on a wider scale. Market consolidation, according to IHS, should be expected as the market becomes more willing to share technologies and adopts a less isolated approach. 9. Targeting enthusiastic end-users According to IHS, the market would do well to target end-users that are already making positive and committed plans to implement access control and security measures. Over the next 12 months, IHS research shows that many governments will increase spending and continue existing programmes, like PAC2 in Brazil and C4I4 in Mexico. Other initiatives will target renewable energy, manufacturing and education.

Convenience-based security is a growing segment of the access control industry. Just as the residential market has been reinvigorated by marketing as well as new technologies and innovations from newcomers like Google, MSOs and existing providers like ADT, IHS believes that the access control industry could jump-start the SMB market with new, enticing and innovative technologies. After decades of providing magnetic strip readers, push PIN and card readers, the access control industry is realising that not all end-users need high-grade security, and that convenience should have a larger role in the future and be part of more portfolios.

Governments in all countries and regions are looking to implement a safe, secure and efficient cloud-based solution. Many EU countries, together with the Trusted Cloud (European Cloud Partnership), are in the process of creating best practices and blueprints for countries to follow to address cross-border security concerns. The U.S. is searching for ways to use commercial cloud for government agencies and departments like the Department of Defense (DoD). As 4G mobile coverage expands, more towers will be required, which will create more demand for mechatronic and remote access control to protect the new towers. Rentable office space is helping drive demand for aesthetic locks and centrally managed access control. Facilities managers are also looking to use more ACaaS-type solutions. Higher education across Europe is seeing a big increase in demand in access control, mainly to ease administrative workflows and to attract students, while the U.S. is continuing to spend on school security to protect against violence. IHS also estimate that smart security hardware in the home will grow above 20% year-over year for the next several years as more people look to Zigbee and Z-Wave devices to connect through a central gateway and mobile device. ■

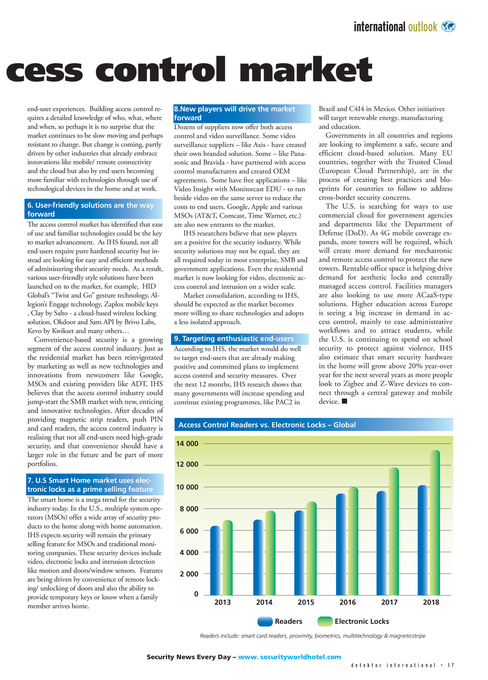

Access Control Readers vs. Electronic Locks – Global 14 000 12 000 10 000 8 000 6 000 4 000 2 000 0

7. U.S Smart Home market uses electronic locks as a prime selling feature The smart home is a mega trend for the security industry today. In the U.S., multiple system operators (MSOs) offer a wide array of security products to the home along with home automation. IHS expects security will remain the primary selling feature for MSOs and traditional monitoring companies. These security devices include video, electronic locks and intrusion detection like motion and doors/window sensors. Features are being driven by convenience of remote locking/ unlocking of doors and also the ability to provide temporary keys or know when a family member arrives home.

2013

2014

2015 Readers

2016

2017

2018

Electronic Locks

Readers include: smart card readers, proximity, biometrics, multitechnology & magneticstripe

Security News Every Day – www. securityworldhotel.com

d ete k to r i n te r n ati o nal • 17