The Physical Access Control Business 2023 to 2028

This report is an in-depth study providing a detailed market analysis of the Access Control business with a focus on electronic Access Control solutions such as electronic locks, readers, control panels and digital infrastructure.

Our analysis provides a comprehensive overview of the current Access Control market landscape and can be used as a tool to guide strategic decisions and investments in the realm of Access Control technology.

This report is the second instalment of a two-part series covering Physical Security Technology. Part 1, covering Video Surveillance, was published in Q3 2023. Both these reports are included in Memoori’s 2023 Premium Subscription Service.

Key Questions Addressed:

- What is the size and structure of the global Access Control market? Who are the leading vendors? How is the market broken down into hardware, software, and credentials? Where are the dominant geographic markets in the world? How are sales split between 9 different industry verticals?

- What are the main drivers for industry growth? How will the market grow over the next 5 years? Which technologies are helping to reshape this market and create new business models?

- How are mergers, acquisitions and investments impacting the industry? How does acquisition activity stack up against previous years in terms of value? How much investment has the market attracted from venture capital and private equity this year?

Within its 221 Pages and 15 Charts, This Report Presents All the Key Facts and Draws Conclusions, so you can understand what is Shaping the Future of the Access Control Industry:

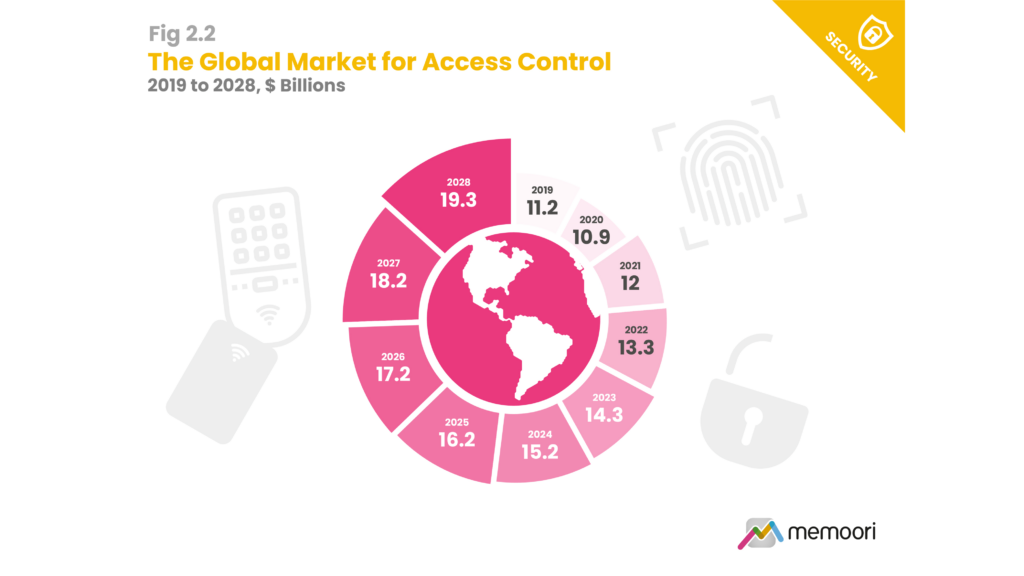

- The access control market contracted in 2020 due to the global pandemic, dropping to $10.85 billion. However, it rebounded strongly with over 10% growth in both 2021 and 2022, reaching an estimated $13.3 billion in 2022. Growth is projected to continue through 2028 but at more moderate annual rates between 5-7%.

- A major driver of access control adoption is ongoing technology advancements enabling more convenient and integrated solutions. Key examples include the rise of mobile access control, biometrics, IoT integration, and frictionless/touchless access control. Regulations related to building security and data protection are also catalyzing investments and system upgrades.

- Access control is evolving through convergence with progressive technologies. While obstacles exist, the benefits appear compelling, pointing toward gradual but increasing adoption across enterprises. The future landscape will likely involve a hybrid model blending physical and digital systems. Those able to provide holistic solutions with strong open platform support and flexible integration will be best positioned to capitalize on these industry shifts.

At only 21 700 SEK for an enterprise license, this report provides valuable information into how physical security companies can develop their business strategy through mergers, acquisitions, and alliances.

In the last 12 months, the sector has seen over $731M in M&A across notable deals like SGT Capital acquiring Elatec RFID Systems for $422M and Assa Abloy acquiring Evolis for $237M. The activity signals a focus on integration, cloud-based solutions, and advanced software capabilities.

Divestments by Carrier and Bosch could significantly reshape the competitive landscape depending on how their security businesses are divested. This aligns with a trend of conglomerates streamlining to focus more on core business offerings.

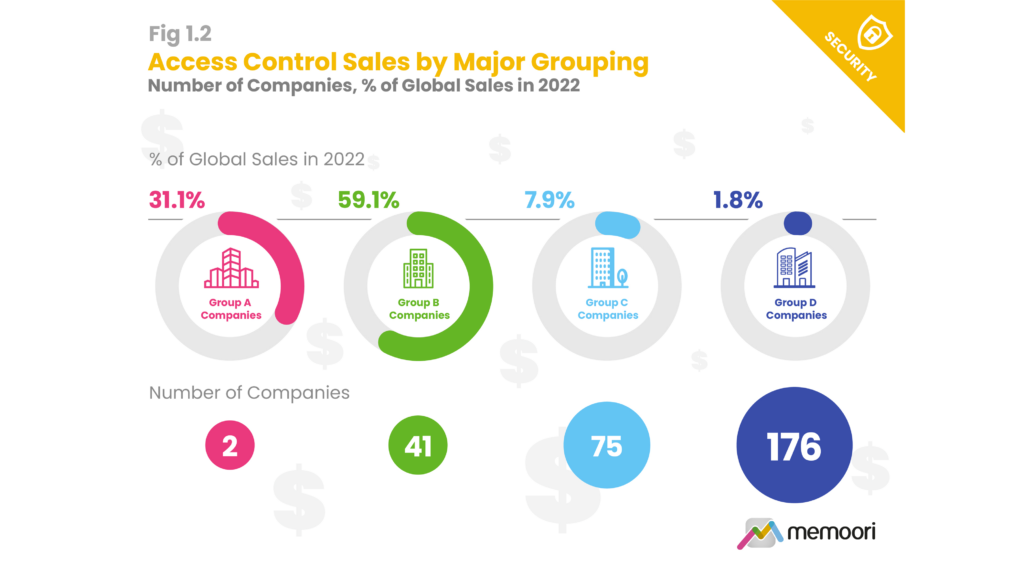

A total of 294 companies have been evaluated over the course of this year’s analysis of the access control market. Companies have been evaluated according to their estimated revenues falling into the scope of this report, with companies grouped and classified by size using our clearly defined definitions, based on 2022 revenue estimates.

Who should buy this report?

The information in this report will be of value to all those engaged in managing, operating, and investing in electronic security technology companies (and their advisors) around the world. In particular, those wishing to acquire, merge or sell companies will find its contents particularly useful. Want to know more? Download the Brochure.

Table of contents

- Preface

- Executive Summary

- 1. The Structure & Shape of the Access Control Business

- 1.1 Access Control Market Structure

- 1.2 Company Classifications & Market Share

- 1.3 Market Dynamics (Porter’s Five Forces Analysis)

- 1.4 Sales & Distribution Channels

- 2. The Access Control Market

- 2.1 The Evolution of the Access Control Market

- 2.2 Access Control Adoption & Investment

- 2.2.1 Market Operation Conditions

- 2.2.2 Key Adoption Drivers

- 2.2.3 Key Market Constraints

- 2.2.4 Spending Plans & Budgets

- 2.3 Access Control Market Size & Growth Forecasts

- 2.4 Market Size, Growth & Trends by Major Region

- 2.4.1 North America

- 2.4.2 Latin America & The Caribbean

- 2.4.3 Asia Pacific

- 2.4.4 Europe

- 2.4.5 Middle East & Africa

- 2.5 Market Size & Trends by Vertical

- 2.5.1 Offices

- 2.5.2 Government

- 2.5.3 Education

- 2.5.4 Industrial

- 2.5.5 Healthcare

- 2.5.6 Retail

- 2.5.7 Transport

- 2.5.8 Hospitality

- 2.6 Access Control Hardware

- 2.6.1 Electronic, Wireless & Smart Locks

- 2.6.2 Readers, Scanners & Keypads

- 2.6.3 Control Panels and Servers

- 2.7 Access Control Credentials

- 2.7.1 Market Size by Credential

- 2.7.2 Comparative Analysis of Credential Types

- 2.7.3 Magnetic Stripe Cards

- 2.7.4 Proximity Cards

- 2.7.5 Smart Cards

- 2.7.6 Mobile Credentials

- 2.7.7 Biometrics

- 2.7.8 Barcodes/QR Codes

- 2.8 Access Control Software

- 2.8.1 Software Market by Deployment Method

- 2.8.2 Dedicated Access Control Software

- 2.8.3 Unified Security Solutions

- 2.8.4 PIAM (Physical Identity and Access Management)

- 2.8.5 Related Software Domains

- 3. IP, the IoT & Open Systems

- 3.1 The Convergence of IP and IoT

- 3.2 Open Standards Initiatives

- 3.3 IoT Growth & Adoption Trends

- 3.4 The Benefits of IP & the IoT

- 3.5 IP and IoT Adoption Challenges

- 3.6 Edge Processing for Access Control

- 4. The Cloud & ACaaS

- 4.1 Types of Cloud-Based Access Control

- 4.2 ACaaS in the Context of Cloud Solutions

- 4.2.1 ACaaS Scope and Sizing Considerations

- 4.2.2 Types of ACaaS Solutions

- 4.2.3 ACaaS Solution Bundling

- 4.3 Cloud Adoption Trends

- 4.4 Benefits of Cloud-Based Access Control

- 4.5 Cloud Adoption Challenges

- 4.6 Cloud & ACaaS Competitive Landscape

- 5. AI & Machine Learning in Access Control

- 5.1 Introduction to AI & Machine Learning in Access Control

- 5.2 AI Innovations & Applications for Access Control

- 5.3 AI Specific Challenges

- 5.4 AI Adoption Trends

- 6. Mobile Access Control

- 6.1 Mobile Technologies

- 6.2 Mobile Adoption Trends

- 6.3 Benefits of Mobile Access Control

- 6.4 Adoption Barriers & Challenges

- 6.5 Mobile Access Control Competitive Landscape

- 6.5.1 Apple Wallet Integration

- 6.5.2 Google Wallet Integration

- 6.5.3 Cross-Platform Solutions

- 6.5.4 Business Models

- 6.5.5 Market Innovations

- 7. Biometrics

- 7.1 Biometrics Technologies & Modalities

- 7.1.1 Facial Recognition

- 7.1.2 Fingerprints

- 7.1.3 Iris & Retina

- 7.1.4 Other

- 7.2 Biometric Adoption Trends

- 7.3 Benefits of Biometrics

- 7.4 Adoption Barriers & Challenges

- 7.5 Regulatory, Legal & Privacy Considerations

- 7.5.1 United States

- 7.5.2 European Union

- 7.5.3 UK

- 7.5.4 China

- 7.5.5 India

- 7.6 Biometrics Competitive Landscape

- 7.6.1 Facial Recognition

- 7.6.2 Fingerprints

- 7.6.3 Multi-Modal Systems

- 7.6.4 Emerging Players

- 8. Multifactor Credentials & Readers

- 8.1 Multifactor Authentication

- 8.2 Multi Technology Readers

- 8.3 Challenges and Drawbacks

- 9. Systems Integration

- 9.1 Convergence Trends

- 9.2 Enabling Technologies

- 9.3 Use Cases and Applications

- 10. Supply Chain Trends

- 10.1 A Retrospective of Pandemic Impacts

- 10.2 Rising Costs Squeeze Company Margins

- 10.3 The Current State of Access Control Supply Chains

- 10.4 Building Supply Chain Resilience for the Future

- 11. Commercial Construction & Real Estate Markets

- 11.1 The Influence of CRE and Construction Markets on Access Control Demand

- 11.2 Commercial Construction & Real Estate Trends

- 11.2.1 Macroeconomic headwinds for commercial construction

- 11.2.2 Regional variations

- 11.3 Commercial Construction Outlook

- 12. Sustainability

- 12.1 The Adverse Environmental Impact of Access Control Systems

- 12.2 Improving Sustainability in Access Control

- 12.3 How Access Control Solutions Support Sustainability

- 12.4 Developing Resilient and Future-Proof Systems

- 13. Skills, Talent & Labor

- 13.1 Key Challenges

- 13.2 Emerging Opportunities

- 14. Cybersecurity & Data Privacy

- 14.1 Convergence of Physical and Cyber Security

- 14.2 Impact on Access Control Trends

- 14.3 Key Threats and Vulnerabilities

- 14.4 Notable Access Control Related Cyber Incidents

- 14.5 Cybersecurity Regulations

- 14.6 Strategies for Mitigating Cyber Risks in Access Control Systems

- 15. Mergers & Acquisitions

- 15.1 Historic M&A Performance in the Physical Security Market

- 15.2 Key Access Control M&A Deals Since 2018

- 15.3 Key Deals to the end of September 2022

- 15.4 M&A Deals to the end of September 2023

- 15.5 M&A Trends and Implications

- 15.6 Planned Divestments and Their Market Implications

- 16. Strategic Alliances

- 16.1 Historic Strategic Alliances in the Physical Security Market

- 16.2 New Strategic Alliances to the end of September 2023

- 16.3 Strategic Alliance Trends and Implications

- 17. Investment Trends

- 17.1 Historical Investment Trends

- 17.2 Key Investments to the end of September 2022

- 17.3 Investment Deals to the end of September 2023

- 17.4 Investment Trend Observations & Implications

List of charts and figures

- Fig 1.1 – Access Control Market Structure

- Fig 1.2 – Access Control Sales by Major Grouping, Number of Companies, % of Global Sales in 2022

- Fig 1.3 – Market Share of Global Access Control Sales by Major Vendor 2022

- Fig 1.4 – Access Control Market: Porter’s Five Forces Analysis

- Fig 2.1 – The Security Market Index (SMI)

- Fig 2.2 – The Global Market for Access Control 2019 to 2028 ($ Billions)

- Fig 2.3 – The Global Market for Access Control by Category 2019 to 2028 ($ Billions)

- Fig 2.4 – Access Control Sales by Region 2022 to 2028 ($ Billions)

- Fig 2.5 – Access Control Revenues by Vertical, % of Total 2023

- Fig 2.6 – Access Control Revenues by Vertical, $ Billion 2023

- Fig 2.7 – The Global Market for Access Hardware by Sub-Category, 2019 to 2028, $ Billions

- Fig 2.8 – The Global Market for Access Credentials by Sub-Category, 2019 to 2028, $ Millions

- Fig 2.9 – The Global Market for Access Control Software, On Premises vs Cloud Based, 2019 to 2028, $ Billions

- Fig 15.1 – Security Deals Completed from 2002 – 2022 Estimated Total Value of Deals, $ Millions

- Fig 16.1 – Strategic Alliances 2008 – 2023

Appendix A

- In-Depth Company Profiles

Companies Mentioned Include AMONG OTHERS

- ACRE | Adatis GmbH & Co. KG | ADT | Aiphone | Alarm.com | AlertEnterprise Inc | Allegion | Allied Univeral Integrated Security Solutions (Incl former G4S Business) | Anviz Global | Apple | Aratek Biometrics | Assa Abloy | Ava Risk Group | Bitkey | Brivo Systems | ButterflyMX | Canon Inc | Carrier Fire & Security (Formerly UTC Climate Controls & Security) | CDVI Group | China Security & Surveillance Tech (CSST) | Civintec (C-Tech Intelligence & Technology Co.,Ltd) | Comelit Group | Commax | Dahua Technology | Datawatch Systems | Deister Electronic | Delinea | Dorlet | Dormakaba | Feenics | FEITIAN Technologies Co., Ltd | Fermax | Fingerprint Cards AB | Fujitsu | Gallagher Security | Genetec | Google | Gunnebo AB | Hanwha Vision | Herta Security | HID Global | Hikvision | Hitachi Security Solutions | Honeywell Building Technologies and Safety and Productivity Solutions | Huawei | HUNDURE Technology Co., Ltd | Idcube | IDEMIA | Identiv | IDEX Biometrics | IDTECK | iLoq | Inner Range | Intelbras | Invixium | ISEO Ultimate Access Technologies | JCI Global Products Division Security Sales | Kastle Systems | Keri Systems | Kisi | Latch | LenelS2 | LG Electronics | Magal Security Systems (MAGS) | Matrix comsec | Miditec Datensystemes GmbH | Mitsubishi Electric | Motorola Solutions | Napco Security Technologies | NEC | Nedap | NXP | OpenPath | Paxton Access Ltd | Primion | Prosegur | QNAP Systems | Qognify inc | RCO Security | Robert Bosch GmbH | Salient Systems Corp | Salto Systems | Samsung | SATEL sp.z o.o. | Schneider Electric | Secom Co | Securitag Assembly Group | Sequr Inc | Shenzhen Jianhe Smartcard | Shenzhen Union Timmy Technology Co.,Ltd | Spectra Technovision Pvt Ltd | Spintly | Suprema | SwiftConnect | TDSI | Telenot Security Systems | Thales – Digital Identity & Security Division | Tiandy Technologies | TKH (Vision & Security Systems) | Ubiquiti | Unico | Uniview | Verkada | Virdi (aka Union Community Co. Ltd) | Vitaprotech | Watchdata | Zenitel | Zicom Electronic Security Systems Ltd | ZKTeco | Zwipe

Diagram och tabeller: 15 st

Släppt: Q4 2023

Pris:

21 700 SEK (exkl. moms) / Enterprise License *

* Enterprise License is a company-

wide license. Anyone within the company can view the document.