The Physical Access Control Business 2025 to 2030

Hardware, Software & Credentials

This report is an in-depth study providing a detailed market analysis of access control, with a specific focus on revenues generated by hardware, software & credentials.

Physical access control (PACS) is evolving from standalone door security into a softwaredefined platform at the center of smart building operations, with cloud architectures, mobile credentials, and artificial intelligence reshaping how organizations secure facilities, manage identities, and optimize workplace experiences, creating both strategic opportunities and competitive risks for everyone from manufacturers to systems integrators.

It is the second instalment of a two-part series covering Physical Security Technology. Part 1, covering Video Surveillance, was published in Q3 2025.

Key Questions Addressed:

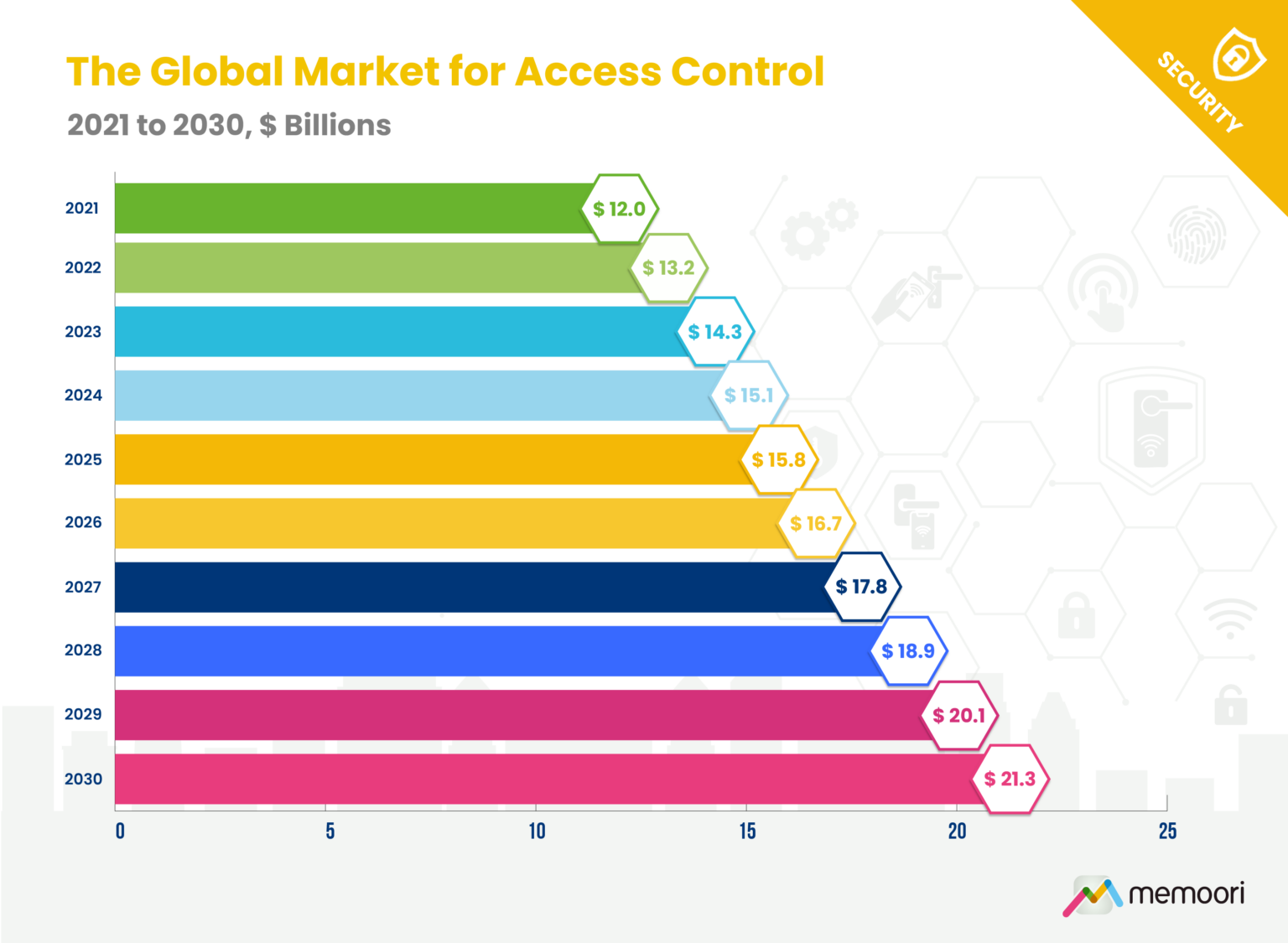

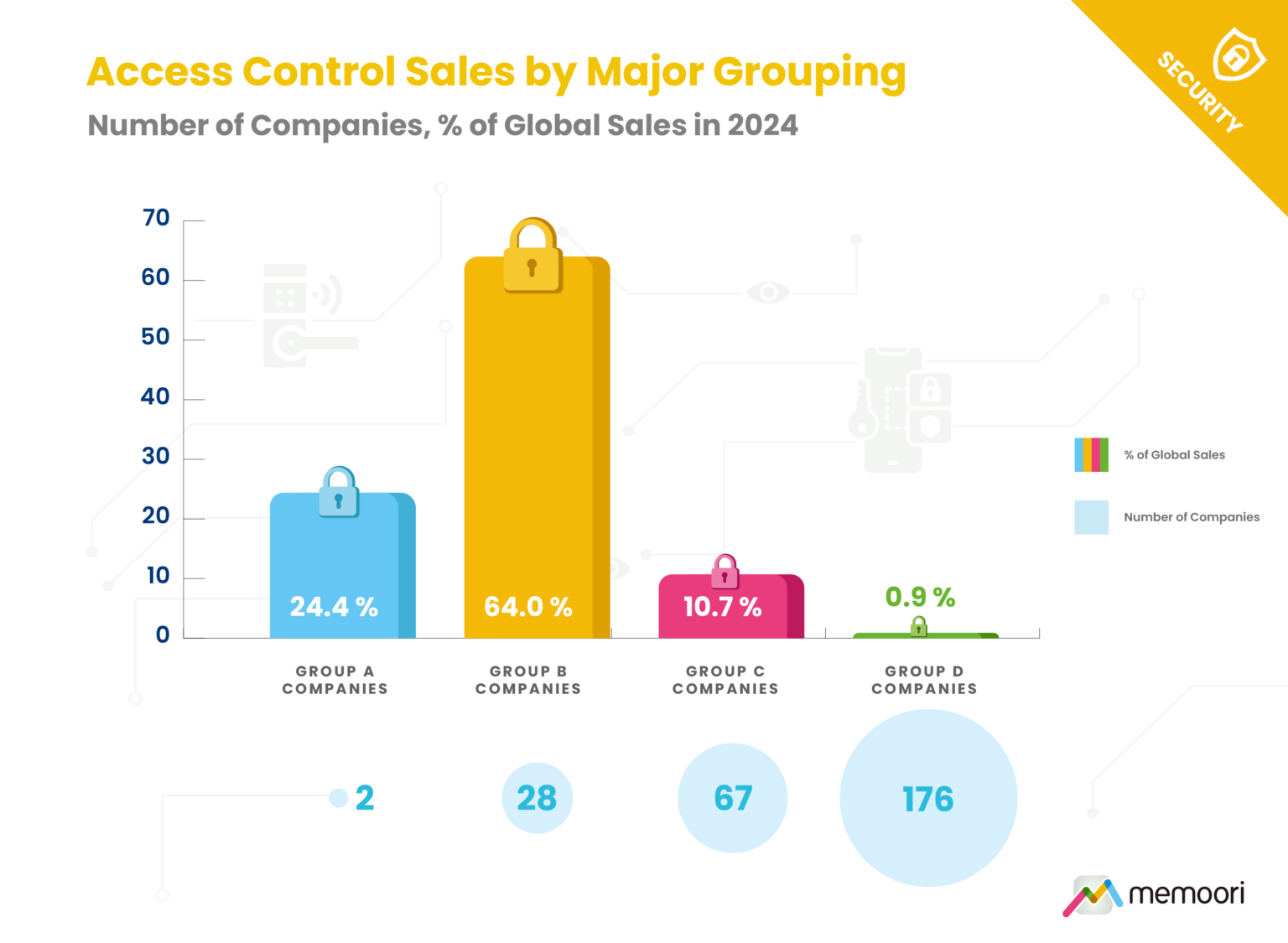

- What is the size and structure of the global Access Control market? The market reached $15.1 billion in 2024 and will grow to $21.3 billion by 2030 at a 5.94 percent CAGR. Group A companies (those with over $1 billion in revenues), together represent approximately 24.4 percent of global revenues. Group B (those with between $100 million and $1 billion) encompasses 28 companies with average revenues of $327 million, collectively accounting for 64 percent of global revenues.

- Which region offers the strongest growth opportunity through 2030? Asia Pacific will overtake Europe as the second-largest market by 2030. Unlike mature markets driven by retrofits, Asia Pacific growth comes from new construction across offices, logistics, manufacturing, and government facilities.

- How is M&A reshaping and consolidating the industry? 16 transactions totaling $7.9 billion were completed between September 2023 and September 2025, led by Honeywell's $4.95 billion acquisition of Carrier's access control business.

Within its 238 pages and 13 charts, this report presents all the key facts and draws conclusions, so you can understand what is shaping the future of the access control industry.

Our comprehensive analysis of the global access control market is structured around 3 core revenue categories: hardware (electronic locks, readers, control panels, and supporting infrastructure), credentials (cards, mobile, biometrics, and alternative formats), and software (on-premises and cloud-based platforms). Our methodology evaluates 273 active companies worldwide, classifying vendors into four groups based on 2024 revenues and analyzing their financial performance, product portfolios, and strategic positioning.

Mobile credentials represent a significant transformation in how organizations provision, manage, and revoke access rights. The market is shifting from proprietary app-based credentials toward wallet-native credentials embedded directly in Apple Wallet and Google Wallet, enabling tap-to-enter experiences without unlocking devices and supporting biometric authentication by default. This report analyzes adoption patterns across vertical markets, quantifies infrastructure investment requirements, and evaluates competing standards.

At only 28 200 SEK for an enterprise license, this report provides valuable information into how physical security companies can develop their business strategy through mergers, acquisitions, and alliances.

Strategic partnerships have become important as structural enablers of innovation, with alliances between credential providers, smartphone manufacturers, and cloud platform vendors accelerating mobile credential adoption and normalizing multi-vendor ecosystems.

The report documents funding rounds, analyzes which technologies and business models are attracting capital, maps strategic alliances shaping interoperability standards, and identifies which vendor partnerships deliver genuine integration versus marketing announcements, critical intelligence for buyers evaluating platform longevity and ecosystem risk.

Who Should Buy This Report? The information in this report will be of value to all those engaged in managing, operating, and investing in electronic security technology companies (and their advisors) around the world. In particular, those wishing to acquire, merge or sell companies will find its contents particularly useful.

Table of contents

- Preface

- Executive Summary

-

The Structure & Shape of the Access Control Business

- Access Control Market Structure

- Company Classifications & Market Share

- Access Control Market Value Chain

- Sales & Distribution Channels

- Pricing, TCO and Lifecycle Economics

-

The Access Control Market

- The Evolution of the Access Control Market

-

Market Dynamics, Investment & Adoption Trends

- Market Operating Conditions

- Adoption Signals and Budget Outlook

- Investment Priorities

- Buyer Behavior, Procurement and Risk

- Market Size & Growth Forecasts

-

Market Size & Trends by Region

- North America

- Latin America & The Caribbean

- Asia Pacific

- Europe

- Middle East & Africa

-

Market Size & Trends by Vertical

- Offices

- Government

- Education

- Manufacturing & Logistics

- Healthcare

- Retail

- Transport

- Hospitality & Food Services

- Datacenters

- Entertainment / Leisure

-

Hardware

- Electronic, Wireless & Smart Locks

- Readers, Scanners & Keypads

- Control Panels and Servers

-

Credentials

- Market Size by Credential

- Comparative Analysis of Credential Types

- Magnetic Stripe Cards

- Proximity Cards

- Smart Cards

- Mobile-Wallet Credentials

- Biometrics

- Barcodes/QR Codes

-

Software

- Software Market by Deployment Method

- Dedicated Access Control Software

- Unified Security Solutions

- PIAM (Physical Identity and Access Management)

- Related Software Domains

-

IP, IoT, and Interoperability

- The Convergence of IP and IoT

- Open Standards Initiatives

- IoT Growth & Adoption Trends

- The Benefits of IP & IoT

- IP and IoT Adoption Challenges

- Edge Processing for Access Control

- APIs, SDKs & the Rise of Platform Ecosystems

-

The Cloud & ACaaS

- Cloud Architectures in Access Control

- Cloud & ACaaS Adoption Trends & Forecasts

- Benefits & Challenges of Cloud-Based Access Control

- ACaaS Competitive Landscape & Business Models

-

AI & Machine Learning in Access Control

- AI Innovations & Applications for Access Control

- AI Adoption Trends

- Key Adoption Challenges & Barriers

- Data Privacy & Ethical Considerations

-

Mobile Access Control

- Mobile Access Control Technologies & Credentials

- Mobile Adoption Trends & Market Dynamics

- Mobile Access Control Competitive Landscape

-

Biometrics

- Biometrics Technologies & Modalities

- Biometric Adoption Trends

- Biometrics Related Challenges

- Regulatory, Legal & Privacy Considerations

- Biometrics Competitive Landscape

-

Multifactor Authentication & Multi Technology Readers

- Multifactor Authentication

- Multi Technology Readers

- Challenges and Drawbacks

-

Systems Integration & Convergence Trends

- Physical-Logical Security Convergence

- Video-Access Integration

- Building Management Systems Integration

-

Supply Chain & Manufacturing Trends

- Supply Chain Operating Conditions

- Geopolitical Impacts on Supply

- Regionalization and Onshoring Trends

-

Commercial Construction & Real Estate Markets

- Influence of CRE and Construction Markets on Access Control Demand

- Notable Real Estate Trends

- Commercial Construction Outlook

-

Skills, Talent & Labor

- Key Trends & Challenges

- Emerging Opportunities

-

Cybersecurity & Data Privacy

- Cybersecurity Implications of Converged Systems

- Threat Landscape & Notable Vulnerabilities

- Regulatory Drivers

- Best Practices for Cyber Risk Mitigation

-

Sustainability

- Sustainability as an Investment Driver

- Making Access Control Systems More Sustainable

- Access Control as a Sustainability Enabler

- Standards, Certifications, and Buyer Expectations

-

Mergers & Acquisitions

- Historic M&A Market Dynamics

- New M&A Deals

- M&A Trends and Implications

-

Strategic Alliances

- Historic Strategic Alliances and Market Dynamics

- New Strategic Alliances (September 2023 to September 2025)

- Strategic Alliance Trends and Implications

-

Investment Trends

- Historic Investment Deals & Investment Market Dynamics

- New Investment Deals

- Investment Trends and Implications

List of charts and figures

- Fig 1.1 Access Control Market Structure

- Fig 1.2 Access Control Sales by Major Grouping, Number of Companies, % of Global Sales in 2024

- Fig 1.3 Market Share of Global Access Control Sales by Major Vendor 2024

- Fig 2.1 The Security Market Index (SMI)

- Fig 2.2 The Global Market for Access Control 2021 to 2030, $ Billions

- Fig 2.3 The Global Market for Access Control by Category 2021 to 2030, $ Billions

- Fig 2.4 Access Control Sales by Region 2024 & 2030, $ Billions

- Fig 2.5 Distribution of Access Control Sales by Building Type 2024, $ Billions

- Fig 2.6 The Global Market for Access Hardware by Sub-Category 2021 to 2030, $ Billions

- Fig 2.7 The Global Market for Access Control Credentials by Sub-Category 2021 to 2030, $ Billions

- Fig 2.8 The Global Market for Access Control Software, On-Premises vs Cloud Based 2021 to 2030, $ Billions

- Fig 11.1 Annual Change in Global Non-Residential Construction Sector Output

- Fig 11.2 Annual Change in Global Construction by Region

Diagram och tabeller: 13 st

Släppt: Q4 2025

Pris:

28 200 SEK (exkl. moms) / Enterprise License *

* Enterprise License is a company-

wide license. Anyone within the company can view the document.