The Transformation of BAS into the Building Internet of Things 2015 to 2020

For a quarter of a century the BAS industry has been working hard at delivering full connectivity across all the different building services. They have been successful in achieving this goal but the solutions have been expensive, lacked flexibility and robustness and whilst they improved the optimization of the buildings performance they could not be fully automated.

More recently with the introduction of IP Networked product across many of the services improved solutions have been made pos sible, however they still fall short of delivering full optimization and automation in commercial and industrial buildings. With the advent of IoT we now have the capability to join “things” together more efficiently and cost effectively in a building; let’s call it the Building Internet of Things (BIoT). This technology can collect data from all the sensors and devices and with Big Data software, analyze all of this data and immediately optimise and fully automate the buildings performance. It can and will add a further dimension through more effective convergence with the business enterprise.

Why do you need this market research report?

- This report will help stakeholders and investors interested in Building Automation to identify emerging trends and business opportunities in the market. In the future BAS suppliers will face the choice of taking a reduced share of the new BIoT business or expanding their horizons to deliver a more comprehensive system through engaging with IoT Data Services.

- This report shows that major disruption is on its way as both the competitive landscape and the supply chain will change for all those suppliers that want to engage in the wider BIoT business, which will reach $76Bn by 2020.

- BIoT will create very significant disruption to the supply side as the contractual procedures and routes to market will be forced to change as BAS morphs to BIoT; and in the process create many winners that have put in place the resources and skills to properly meet this challenge.

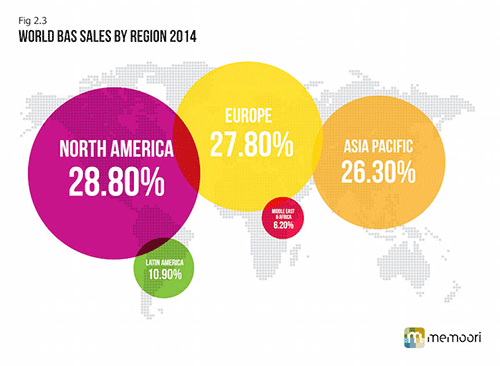

The starting point of the report is to size the current market for all the BAS services and projecting demand until 2020. Memoori estimates that the world market for BAS at installed value in 2014 was $120Bn. This was shared between 9 services include Access Control, Building Environmental Control Systems (BECS / HVAC Control), Energy Enterprise Software, BAS Integration Services, Intruder Alarms, Lighting Controls, Video Surveillance, Fire Detection and Others.

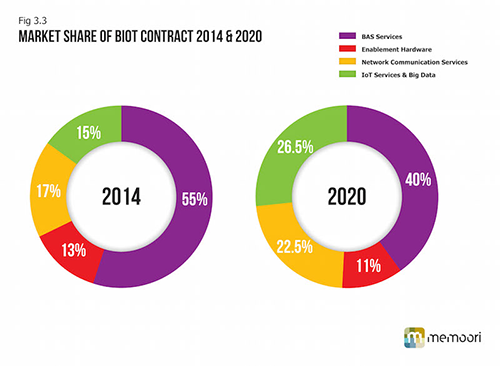

Memoori estimates that the value of the BAS hardware associated with BIoT projects at installed prices in 2014 was $35.15Bn accounting for approximately 55%, Enablement Hardware took a 13% share, Network Communication Services 17% and IoT Data Services secured 15%.

Projecting the sales of these 4 major components through to 2020 shows a significantly changing picture with IoT Data Services increasing its share to 26.5%, Network Communication Services rising to 22.5%, whilst the contributions from Enablement Hardware and BAS Services declining to 11% and 40% respectively.

Within its 240 pages and 32 charts and tables, the report sieves out all the key facts and draws conclusions, so you can understand what is shaping the future of building automation and the smart building industry;

- Memoori expects that for the Building Internet of Things (BIoT) to deliver a comprehensive and cost effective solution across all the services that now co-exist in Smart Buildings it will require fundamental changes on how systems are designed and contacts to install are let. We expect that in the future, BIoT will be organized around 4 main contracts, which are identified and analyzed in the report.

- BAS Services from a whole range of sensors and devices from building energy controls to physical security products are gradually but inevitably morphing into a more comprehensive and fully automated BIoT solution.

- However this report shows that manufacturers of BAS products are in danger of letting this opportunity pass them by as new players from the IT and Communications Industry take the driving seat and could steal the new opportunities that the business offers.

Starting from only USD $999 this report provides valuable information into how & why the Building Automation Industry is Transforming into the Building Internet of Things AND how companies can develop their Smart Building business through Merger, Acquisition and Alliance.

Who should buy this report?

The report focuses on market sizing and opportunities for Building Automation Systems, providing a fresh market assessment based upon the latest information. The information will be of value to all those engaged in managing, operating and investing in BAS & Internet of Things companies (and their advisors) around the world. In particular those wishing to develop their business within the Smart Building Industry will find it particularly useful.

Table of contents

- Preface

- The Executive Summary

- Introduction

- Market Size of BAS and its Transformation into BIoT to 2020

- 2.1 Market Size & Share of BAS Services 2010 – 2014

- 2.2 Market Size & Share of BAS Services 2014 and Forecast to 2020

- 2.3 Market Size & Share of BAS Services by Region 2014

- 2.4 Market Size of BAS by Type of Building 2014

- 2.5 Market Size of BAS Services by Project Type

- 2.6 The Integration of BAS Services Morphs to BIoT

- The Market Size Building Internet of Things (BIoT) & its Development

- 3.1 BIoT – New Business – New Contractual Procedures – New Routes to Market

- 3.2 BIoT Market Sizing Data 2014 – 2020

- 3.3 BIoT Market Size By Major Contract 2014 – 2020

- 3.4 BIoT Market Size By Major Region

- 3.4.1 North America

- 3.4.3 Latin America

- 3.4.3 Asia Pacific

- 3.4.4 Europe

- 3.4.5 The Middle East & Africa

- 3.5 BIoT Market Size by Building Type 2014 – 2020

- 3.6 Vertical Market Prospects

- 3.6.1 Retail

- 3.6.2 Healthcare

- 3.6.3 Education

- 3.6.4 Real Estate

- 3.6.5 Hospitality

- 3.7 Proving the Business Case for BIoT investment in Buildings

- 3.8 How the BIoT Market will Develop

- Supply Side Structure & Distribution Channels

- 4.1 The Building Energy Controls Supplier (BECS) Structure

- 4.2 The Physical Security Supplier Structure

- 4.2.1 The Video Surveillance Business

- 4.2.2 The Access Control Business

- 4.2.3 Intruder Alarms & Perimeter Protection

- 4.3 The Lighting Controls Supplier Structure

- 4.4 Enterprise Energy Management Software Supplier Structure

- 4.5 Smart Sensor Networks

- 4.6 Distribution Channels for BAS Services & BIoT

- Wireless Technology Developments & Future Trends

- 5.1 Wireless Controls

- 5.2 Wireless Technology in Lighting

- 5.3 Wireless Technology in Physical Security

- 5.3.1 Wireless in the Video Surveillance Market

- 5.3.2 Wireless in the Access Control Market

- 5.4 Wireless Developments

- Open Systems

- 6.1 A Complicated and Combative Standards Landscape

- 6.2 Building Specific Protocols

- Key Market Drivers

- 7.1 Economic & Business Drivers

- 7.2 Technology Drivers

- 7.3 Energy Efficiency / Environmental Drivers

- 7.4 Research Regulatory and Legislative Drivers

- Market Barriers & Challenges

- 8.1 Security & Privacy

- 8.2 Network Capacity Crunch

- 8.3 Skills

- 8.4 Ownership, Control & Stakeholder Perspectives

- 8.5 Data Volume & Complexity

- 8.6 The Investors need to Reap the Rewards

- 8.7 The Integration of Building Services

- 8.8 The Impact of IT Convergence & Value Creation

- 8.9 BAS Companies Maintain their Role in Retrofit Projects

- Market Strategies & Business Models

- 9.1 Building Energy Controls Suppliers

- 9.2 Access Control Suppliers

- 9.3 Intruder Alarms Suppliers

- 9.4 Video Surveillance Suppliers

- 9.5 Lighting Controls Suppliers

- 9.6 Positioning of Major IT Firms

- 9.7 Infrastructure Providers

- 9.8 Software Providers

- 9.9 Chip Makers

- 9.10 Vertical market integration and the Building Internet of Things

- 9.11 IoT Supply Chain Partnering

- 9.12 The Growth in Cloud Based Offerings

- 9.13 IP & Patents

- Merger & Acquisition in the BIoT Business

- 10.1 Mergers & Acquisitions

- 10.2 BIoT & Big Data Investment Deals

- 10.3 Private Equity & Venture Capital Analysis

- 10.4 Investment Market & M&A Forecasts

- Merger & Acquisitions by BAS Services Companies

- 11.1 Schneider Electric Acquisition Activity

- 11.2 ABB Acquisition Activity

- 11.3 Siemens Acquisition Activity

- 11.4 Honeywell Acquisition Activity

- 11.5 Johnson Controls Acquisition Activity

- 11.6 Other BAS Suppliers Acquisition Activity

- Investment in Energy Enterprise Management Software Companies

- The Top Potential Merger & Acquisition Targets

Appendix

- A1 – Major Building Market Players & Their Big Data Products & Services

- A2 – M&A and Investments in BIoT Companies – January 2013 to March 2015

- A3 – Venture Capital Companies & Their BIoT Investments

- A4 – Glossary of Terminology

List of charts and figures

- Fig 2.1 – World BAS Sales 2010 – 2014

- Fig 2.2 – World BAS Sales 2015 – 2020

- Fig 2.3 – World BAS Sales by Region 2014

- Fig 2.4 – World BAS Sales by Building Type 2014

- Fig 3.1 – The Internet of Things in Commercial Buildings

- Fig 3.2 – Big Data Investments by Industry, % of Respondents

- Fig 3.3 – Market Share of BIoT Contract 2014 & 2020

- Fig 3.4 – The Global Market for BIoT & Big Data in Buildings 2015 – 2020, $Bn

- Fig 3.5 – The Market for Big Data in Buildings by Region 2015 – 2020, % of Global Market, Revenue $Bn

- Fig 3.6 – The Market for the BIOT & Big Data in Buildings – North America, 2015-2020, $Bn

- Fig 3.7 – The Market for the BIOT & Big Data in Buildings – Latin America, 2015-2020, $Bn

- Fig 3.8 – The Market for the BIOT & Big Data in Buildings – Asia Pacific, 2015-2020, $Bn

- Fig 3.9 – The Market for the BIOT & Big Data in Buildings – Europe, 2015-2020, $Bn

- Fig 3.10 – The Market for the BIOT & Big Data in Buildings – The Middle East & Africa, 2015-2020, $Bn

- Fig 3.11 – World BIoT Sales 2014 – Market Share by Building Type

- Fig 3.12 – Percentage of Companies Investing in IoT by Industry

- Fig 3.13 – Economist Intelligence Unit – IoT Business Index

- Fig 3.14 – Internet Enabled Devices in Buildings Currently Connected to Networks

- Fig 4.1 – Distribution Channels for BAS Products 2014

- Fig 5.1 – Wireless Sensor Network Providers’ Target Internet of Things Markets

- Fig 8.1 – Model of Integrated Building Services & Convergence with IT

- Fig 9.1 – % of Global IoT Patent Applications, Selected Countries

- Fig 10.1 – BIoT and Building Related Big Data Deals Completed from 2010 to 2014

- Fig 10.2 – Private Equity and Venture Capital Investments, $m 2010 to 2014

- Fig 10.3 – BIoT and Building Related Deals, Projection to 2020

List of Tables

- Table 10.1 – Major M&A investors 2010 to Date

- Table 10.2 – Leading VC Investments and Investors

- Table 13.1 – Potential Merger & Acquisition Targets

Companies Mentioned Include (Among Others)

- ABB / Acti / Acuity Brands / Allegion / Arecont / AutomatedLogic / Avigilon / Axis Communications / Bosch / Brivo / BuildingIQ / Canon / Cisco / CREE / Cylon Controls / Dahau / Delta Controls / Dialight / Digital Lumens / Distech Controls / Dropcam / DVTel / Ecova / EnergyCAP / EnerNOC / Enlighted / eSight Energy / FirstFuel / Flir / Genetec / Google / Gridpoint / Gunnebo / Harvard Engineering / HID Global / HIKVision / Honeywell / Infinova / Johnson Controls / Kaba / Lucid Design Group / Milestone Systems / Mobotix / Nest / Opower / Osram / Pacific Controls / Panasonic / Pelco / Philips Lighting / Priva / Qube/ Samsung / Schneider Electric / SCIenergy / Siemens / Sigfox / SmartThings / Sony / Stanley / TDSi / Toshiba / Tridium / Tyco / Ubiquiti / Uniview / UTC / Verisae / WEMS / Xtralis / Zwipe

Now you can order this report directly from AR Media International for only USD 999.